Social Media Marketing For Mortgage Brokers

Social media marketing for mortgage brokers is of ever-increasing importance to enable mortgage brokers to organically increase their referrals and brand awareness.

In this episode of the MLC Show, host Sean Rogers sits down with Chris Targett, Founder of Social For Brokers, to outline the social media strategies he has deployed successfully with mortgage brokers helping them grow their businesses and increase referrals.

You can read the interview if you scroll down or if you prefer to listen click on the Spotify/Apple Podcasts logos or if you prefer to watch click on the YouTube logo below.

Social For Brokers

If you are a mortgage broker in England & Wales you can reach out to Chris and Social For Brokers here

Social Media Marketing For Mortgage Brokers

Social Media Marketing For Mortgage Brokers with Chris Targett, Founder of Social For Brokers.

Chris’s knowledge of the property market, estate agency, and mortgage brokers led him to set up “Social For Brokers”, enabling him to help mortgage brokers create relevant content which will in turn increase interaction on mortgage brokers social media channels.

For those who may not know, Chris, could you start by telling us a bit about yourself as well and your background in social media marketing, specifically in the context of the mortgage industry?

So I was an estate agent for six years and I worked as a negotiator and a lister, and my job was to get mortgage appointments in front of the advisors in the office. So I knew the pain points of the clients. Did a web design course at night, aside from work, just something to dabble in, and then realised that a lot of mortgage brokers needed help with their social media.

So I started helping a few mortgage brokers with their social media whilst I was in full-time estate agency. And the biggest pull for them was it saved them so much time because I was looking after it and they didn’t have to explain to me what a mortgage was, what a property transaction was, etc.

I had all the knowledge so they could just leave me to it. So fast forward a few years and in 2020, I was put on furlough by the estate agents and thought, look, I’m never going to have a better opportunity than right now to do this for three months full-time.

So I went at it, landed the first clients and over the past 3 years we are coming up close to around 130 mortgage brokers as clients taking control and helping with their social media content.

And the big pull is we save people time. They don’t have to think about what to post because we know what works on social media, but the main thing is they don’t have to “to and fro” with us and say, look, you can’t use that word, you’ve got to use the word deposit or agreement in principle. You’ve got to make sure the disclaimers are in place, etc.

That’s the thing that clients like most about us. That they can just leave us to it. So that, in a nutshell, is what we do for people.

And why is social media marketing important for mortgage brokers and how can it contribute to their success?

You have got to be careful not to make assumptions in that area, in that everyone will agree social media marketing is important for any business. But when you’re a mortgage broker that might be getting most of your business through, say, word of mouth recommendations, you might have some B to B referral partners like estate agents, then why is social media marketing going to be important, and how can it contribute to their success?

Okay, so how can social media help mortgage brokers? Well, if we look at it from a different point of view, say that you were looking for somebody to come around and do your garden, and you’d spoken to some friends, and one of your friends said, check out Smith’s Gardeners, and somebody else said, check out Jones Gardeners.

So you look up Smith’s Gardeners. They’ve uploaded three times in the last week to social media. There’s a post about a lovely job that they’ve done. There’s a post about their dog and then there’s a post that they’ve shared a local business’s butchers. I can see that they’re sharing local people’s stuff.

So they’re local. I can see their work and I can see a bit of their personality through the posts. So you look at Smith’s Gardeners and you book them in.

You then go on to Jones Gardeners. They have not uploaded on their social media channels for the last six months. Which ones are you going to phone?

You’re always going to phone Smith’s because you can see that they are still in business and doing business for one. That’s a big thing. You might not even think Jones are in business and you know more about Smiths straight away from their three social media posts.

So to me, social media now is as important as a website was 5-10 years ago. You must have a presence on social media. That’s how important it is. And we’ll get into some of the strategies of how you can use social media for lead generation in a bit.

But for me, the foundation and the bare minimum for social media is to use it as a verification tool. So when people search for you, they know that you’re still in business.

What are some of the common misconceptions or challenges that mortgage brokers might have when it comes to using social media effectively? Not just using it, but using it in an effective way.

Okay, so when social media started, it was very easy. We could upload a post, people would see it, people would interact, and people would send us a message to book an appointment because there weren’t as many people on social media as there are now.

The common misconception is if you upload to social media, it generates you business. Unfortunately, we’re not that lucky anymore. You have to upload content that’s topical. You’ve got to make sure that it’s branded. I always use the Sainsbury’s carrier bag analogy. If you see somebody walking down the street with an orange carrier bag, you automatically know it’s Sainsbury’s.

You don’t even have to look at the logo. And Sainsbury’s is imprinted in your mind. That’s how strong your brand needs to be on social media. You need to make sure that you own a colour, you own a font, and you own your logo. So if anybody’s scrolling through social media and they see the colour blue, they automatically know that it’s Rogers mortgages, as an example.

What you also need to make sure you’re doing on social media now is not just posting, you need to make sure that you’re engaging with your audience.

When someone replies to one of your posts no longer leaving that comment alone. What you need to be doing is liking that comment, reply to that comment to say thank you very much. If you can, try and respond with a question, because what that does is it draws another comment to your post, and over time, you’ll build more and more comments.

This does two things. Says to Facebook that people are interested in your content because you’re getting more and more comments, so it’ll push your next post out to more people. But the second thing is, people see that post, and as humans, we’re nosy. So we want to see if there’s an argument kicking off in the comments.

Because if you say something with six comments. You’re clicking on it to find out who’s having a go at each other. But when you click in there, it’s actually a positive experience that they can see. They see that you have responded to Mike Smith saying, great review, or whatever it is. So that’s the common misconception at the moment, is you can no longer just rely on uploading to social media.

We can create content for people and put it out there, but you guys need to be in your channels and engaging with your audience because these are the people that are going to be booking appointments with you.

Would you have any success stories or examples you could provide us with relating to mortgage brokers?

So you’ve got the likes of Redditch Mortgage Advice. So this was my first ever client in the industry and we’re still working together years down the line.

Kate has gone from herself, and I think she had two admin staff at the time in 2018, and now there’s a team of 17 people. If you listen to a podcast episode I did with her, she will say 90% of her leads come from social media. That’s from consistently posting. But also she will sit on her phone and respond to people personally.

She will respond to comments. So have a little look at Redditch Mortgage Advice.

My good friends down on the South Coast, Mewstone Mortgage Advice. Those guys are really big on doing their own videos, so they will engage with their audience. They’ll do like first-time buyer events on Instagram, they’ll engage with their audience on Facebook. They really integrate themselves into the local community.

So they will talk about local events going on. And from a branding point of view, we create their graphics and their visuals. So whenever you see the yellow and the black within that area, you automatically know that it’s going to be Mark and Nathan down there, that for their colours, they own that particular area.

I mean, there are countless examples. You’ve got Adele Forbes at West Yorkshire Money. She’s massive on community. She will engage with her audience, consistently post, do a lot of personal stuff as well, like her and how long her partner has been together. Like the photo of the dog. Stuff like that is really powerful.

So go and check those guys out. That’s just a few of the examples I would give.

I did an interesting interview years ago now and they said as a test, message, 20-30 people in your phone book who should know what you do for a living and ask them, do you know what I do and really what it involves? He said it would be absolutely staggered that even people close to you don’t know really what you do for a living.

They think they know but they’re not 100% sure. And even if they know the kind of title, whether it be a solicitor or whether it even be mortgage broker, they don’t even quite know the niche areas that you might specialise in or specifically what you do.

And the point that person was trying to make was, I think particularly if you’re a mortgage broker, if you’re in that kind of a profession, then making your personal channels professional in that way, a bit like, your example of Kate.

So Kate’s Instagram is the Mortgage Lady Kate. So on Instagram, obviously with consumer duty as well, you have to be careful because there are new regulations around it.

But completely agree with, like, there’s nothing stopping you from sharing your content from your business page onto your personal one. Tell people what you do. Well, I think it’s more sort of a reminder.

And you can still have your personal stuff on there.

But in terms of good content, that would be subtle. That is your little jab, jab. And I don’t even think you need to land the hook at that point because people are just in your own network, aware of what you do, aren’t they?

You’ve got to think of your social media audience as a little town. So say if your social media audience has 300 people following it on Facebook, okay, so they all live in this little town, okay?

And they walk about that town. They go to work in that town, they drive in that town. And when they’re on their journeys, you think about the journey of them scrolling through social media. They’ll pass billboards. You need to think of your social media posts as those billboards dotted around the town.

Not everybody from the town or your audience will see every billboard, and every social media post, they might pass one or two of them out of ten, okay? But with that billboard, it’s very rare that they will walk up to that billboard, take a selfie with it, and share it with their friends.

It will be very rare that they look up at the billboard and say, oh, I like that. But we’re expecting people to do that on social media. So billboards, we pass them every single day, yet we don’t even give them a second thought. People will do that with social media posts.

But just because they didn’t give the billboard a second thought, it doesn’t mean that they didn’t take in the information or take in your branding. So even if somebody scrolls past your post or walks past a billboard, in this analogy, they take in the branding, the logo, the message.

So just because they don’t like, comment, or share that post, it doesn’t mean that they haven’t taken it in.

On the topic of social platforms, what’s your view on mortgage brokers coming at this in terms of, should they be on every single social platform from a time perspective? Should they be focusing more on particular social platforms at the moment? And if so, which ones and why?

Okay, so this is my personal view. Facebook is still the number one platform for service-led businesses. Okay, so mortgage broker, estate agent, selling video services, any service.

Facebook is fantastic for that. Instagram is a great channel if you have a product to sell something a bit more sexier, pair of shoes, bit of clothing, because you can take photos of it. But caveat, Instagram is very good if you want to sell your company off the back of your face, because you can use the likes of Instagram Stories to show you what you do and behind-the-scenes content.

Okay. LinkedIn is very good if you want to niche down into a specific type of client. So you can target kind of, if you wanted to target like a particular type of workers as a mortgage. Then you’ve got the likes of TikTok.

TikTok is a fantastic platform for brand awareness and trying to make yourself go viral. I’m going to say that in inverted commas because it’s bloody tough. Okay. But TikTok is a great way to give people really informative content. So people think TikTok’s all about funny dances and trends? Yes, it is.

But there’s also a space for really informative content. Really basic level. What is a mortgage? How much deposit do you need? But it’s all about building your name on there. And then one that a lot of people miss is Google My Business. Okay, so Google My Business has a little section in it where you can upload.

They’re called updates. And what that does is it signifies to Google that you’re using their tools, so they’re much more likely to push you up in the searches. But it also shows, remember when we talked about verification? Well it also shows somebody looking for a mortgage advisor near me. You’re the only person out of all the Google My Businesses that have uploaded in the last two weeks.

So I’m much more likely to call you than Smith’s Mortgages who haven’t uploaded for three months. So that’s a bit of a recap of the channels.

If it was me starting out brand new, I would go to Facebook and I would utilise the likes of your Facebook friend list that you’ve already got, because family and friends can be clients as well.

Utilise Facebook groups, utilise Facebook reels. There’s massive reach on Facebook reels at the moment. Then I’d then jump over to Instagram. So I will use Instagram for Instagram Stories to show a bit of behind-the-scenes content. The photo of my cup of tea, the photo of the dog, me at the desk, behind-the-scenes stuff.

That’s where I would start. So if you’re not doing anything on social media at the minute, start with Facebook. If you’ve kind of been using Facebook quite a bit, go to Instagram and then start doing videos.

How you would look at actually creating the content for those elements?

Would you tailor different content for each platform to really resonate with your audience? Or do you think that similar questions or educational content would potentially apply regardless of platform?

So you’ve hit the nail on the head there.

If you’re doing educational and informative content, you can post that to all channels, because it’s relative to everybody. When you write a post, about 100% mortgages are open to homeowners and first-time buyers, that’s relevant to all parties. But if you’re sat on LinkedIn wanting to, for example, say that you want to target people that are, I don’t know directors of companies and help them with limited company mortgages buy to let mortgages and business protection, you want to target that content at that particular individual. So what you want to do is to build an ideal client avatar.

How old are they? Where do they work? How much is their income? What do they watch on TV? Where do they holiday, where do they shop, and build that content?

You would put a post out saying business owners: We know you don’t have the time to look at your mortgage, let alone your business protection, because we know that you’re busy.

You’re managing staff, you haven’t even got enough time to get the kid’s swimming bag together and you keep missing swimming and that kind of stuff. That makes it a bit more relatable. That’s the type of stuff that will work on LinkedIn. When you’ve posted on LinkedIn, you have to sit there and engage with everybody else’s content.

There’s no point posting and running on LinkedIn because yes, it’s good for reach and there’s organic reach, but you’ll get so much more if you sit there and engage with these business owners’ content because your name will be forefront of their minds.

That is along similar lines to the Gary Vaynerchuk $1.80 strategy, e.g. leave your 2 cent across the top 9 posts for your top 10 hashtags……

So what he says, and if nobody watches Gary Vee, please go and see him. He swears a lot. So if you are offended by swearing, you might want to swerve him. But he’s massive on social media. And what he says is it’s the $1.80 strategy, which means every day leave your 2 cent’s worth or the top 9 performing posts on the 10 topics most relevant to you.

So that means don’t just comment a thumbs-up emoji on the bottom. Don’t just comment with a house emoji. Go on there and go right, a business owner writes about the struggles that they’re having with staff. Write on that. Do you know what? We’ve had this in the past. I found that rewarding our staff with a team day out every month really makes a difference.

That’s a really insightful comment. People will remember your name more so than just a thumbs up. But the best part about LinkedIn is it’s not just the author of that post that you’ve commented on that gets the notification on LinkedIn. A lot of people will see your comment and your name without having to click on the comments.

So it’s a great way to increase your brand awareness for yourself and for your company.

In terms of mortgage brokers creating content, forming the ideas, but then also doing it consistently, how do they get the ideas? How do I maintain the consistency aspect of this?

That’s a couple of the biggest struggles that a lot of mortgage brokers come to us with. It’s kind of like, Chris, I sit there on a Monday morning, I know I’ve got to post to social media, but I’ve got that case to sort out. I’ve got an offer going through today and I’ve got a member of staff off sick.

Social media goes to the bottom of the list. So let’s talk about some strategies you can put in place to keep on coming up with consistent, good, topical ideas.

The first thing is if you go to our website, socialforbrokers.com, and on there you can download a cheat sheet of seven lead-generating content idea platforms.

I’m going to talk you through one or two of them today, but that sheet gives you seven places you can go to get really good content ideas. Download that, you’ll never have to think of an idea again.

Buy yourself a cheap notebook.

Go and pick one up for a quid, or go and get one of your lenders to give you some free notebooks. When you’re on the phone doing your mortgage appointments, put that notebook by the side of you and list every question that you are asking.

Let’s look at the mortgage appointment.

So they might say, how many pay slips do I need? What deposit do I need? Can I move from a tracker to a fixed? Is my life insurance through work enough? Did you get my email about my credit rating? What does my credit rating need to be? These are all questions that you guys are asked as mortgage brokers on a day-to-day basis.

Because you’re asked them all the time, they kind of just drop out your head. You don’t think about them. Those are questions that your audience is asking you on a phone call. So your social media audience are going to be asking exactly the same. So do posts answering those questions, you don’t have to make a fancy visual at the minute.

You could just write it out on social media or quick selfie and say, these are the top five questions I’ve been asked this week. So there’s five posts for you straight away. Okay, the next tool, which is a really useful tool, is something called “Answer The Public”. What answer the public does is you can put a keyword in there so you could put mortgage, first-time buyer mortgage, income protection, critical illness cover, and you can search.

What it will do is pull through all of the search terms that Google has had in the last 28 days, and you will have a list of all the questions that have been asked on Google in the last month. So you know that those questions people want answers to at the minute, if people are asking them on Google, your audience on social media, will be thinking exactly the same questions.

From a compliance point of view, can you get a mortgage with 100%? Can I buy a house without a deposit? Can I buy a shared ownership property? These are all questions people are asking.

So as a mortgage broker, you need to be answering them. Okay, so those are two from the seven on the free download. So go and download those. socialforbrokers.com.

Once you’ve got the ideas, how do you stay consistent? Use something like Canva.

So Canva is a free online software design tool and it’s very easy to do. We’ve just trained one of our clients in a week on how to use it by using templates. So Canva has templates in it, built in that are ready to go. When you sign into the account, create a new design.

Go to the top left where it’s templates or design. Type in the box “mortgage” and you’ll have hundreds of templates ready. Click that, it’ll put it into the middle for you. Change the colours to your company and then right in there. 100% mortgages available.

You can download it and put it onto your social media. If you did it right, you could sit there for an hour and bash out a month’s worth of content, two posts a week just using templates and using the questions from your lender’s notebook that you’ve got for free.

And then you can use something called Buffer. So Buffer allows you to add three social media channels to it. So you can go to Facebook, Instagram, and LinkedIn, and you can schedule your social media posts to those channels at 06:00 a.m, 09:00 p.m, you could do it three months from today if you wanted to.

So you can schedule those bits of content and it will go out automatically, LinkedIn, Facebook, and Instagram for you. So we’ve covered the content, we’ve covered the uploading and we’ve covered the scheduling of those. Use Buffer to schedule, use Canva to create, and use your notebook for ideas and your content and your social media channels will transform within six months.

Something I’ve seen a few people doing, which I think is really good, if you want to get technical with it on TikTok and Instagram, is getting green screens.

On your phone in TikTok you can put a news article as the background behind you, so there could be something really topical in the news, and you can literally have that article behind you so people can read the headline and even some of the words behind you, and you provide a summary on it.

So it could be news about a particular lender. They’re releasing a new rate, you’re going to need a 35% deposit or whatever the terms might be. That might give you some ideas for content, because you’re actually talking about news that’s been released, things that are topical and are happening right there. But that would be for people who are obviously a little bit technical, who are happy using that, learning a bit about that, and feel comfortable being on screen.

What are your thoughts and suggestions in respect of videos on social media for mortgage brokers?

Now we’re going to delve into the more advanced side where people are comfortable doing videos, even if you’re not comfortable doing videos. My one top tip would be to walk when you’re doing videos. The reason it works is that we walk when we’re on the phone to people.

Because as humans, we were made to speak face to face. So it’s in our biology that when we’re talking face to face, we’re looking for movement from those other people. So when we’re on the phone to somebody, we have to walk because our mind’s telling us there has to be some kind of movement when there’s conversation.

So when you’re doing a video, it’s very hard to just sit there with face to camera and talk to the camera. So instead of doing that, if you’re starting in video, go out for a walk, even if it’s in your back garden, and just record whilst you’re walking. It’s so much easier.

Your mind flows a lot better and your word flows a lot better. So if you started to do video, the green screen thing that Sean talked about it is fantastic, and TikTok is really rewarding the algorithm if you do that at the moment. So you’ll have, like you said, the article in the background and you can talk about it.

Okay. Another tool that I’d recommend is to go onto a website called Orca. It’s social media software. But what they do is if you sign up to their newsletter, they’ll give you a list of all the latest TikTok trends.

And there are links in there. I think it’s a Google Doc, and you can see all the TikTok trends that are working at the moment. So if you go onto TikTok and they’ve got Instagram in there as well, you can use the most effective strategies at the moment for growth on those particular channels.

It works exactly the same. If you’re wondering what to talk about for the video, the notebook again is so powerful again if you’re asked, Chris, you’re on the phone, Bank of England is meeting tomorrow. What do you think they’re going to do? Bang, that’s a video. Let me do a video.

Okay. I think maybe it might go up 0.25% but might not affect mortgage rates because it didn’t last time. But we never know that’s a video straight there because that’s what the news is going to be talking about. It’s what your clients are going to be consuming from the news.

So why not give them a mortgage broker’s point of view on the news as well?

What would your tips be for brokers that might be comfortable in some areas and not others? There are a lot of people that might be quite private. There might be some people who don’t feel happy on camera.

Okay, if you’re not good at video instead of putting aside 6 hours on one day to do video, spend those 6 hours writing long-form content. So if you’re really good at writing and you like writing, write a case study or spend that time engaging with your local businesses.

Go onto Facebook at the top, right on desktop, you’ll see that there’s a little circle with your personal profiling. Press that and switch to your business. So now we’re going to be interacting as your business page and sit there and search local groups, local pages, local goings on, and follow all of those things.

Sit there and engage in those things. So there’s the local butcher. They upload a photo of them taking preorders for Christmas. So you can order a nut-roasted turkey or a bit of beef, comment on there, and go, “Oh yeah, can’t wait to order the turkey”. “We always get ours in early from this place.” That shows your business name has commented on that post.

So all of their audience, if they click into the comments, they’ll see (as an example) Smith Mortgages sit there and engage for an hour a day, every day. If you don’t want to do video you will fast become like a leader in your town.

People will see it and eventually, you’ll know when it happens because your friends and family will message you, going, bloody hell, I’m sick of seeing your face everywhere, or I’m sick of seeing your business everywhere. That’s when you’ll know that you’ve achieved it. Because if your family and friends are seeing your business everywhere, then you know that your potential clients are seeing you everywhere.

What expectations then should mortgage brokers have in respect of social media marketing? I think some brokers might say, or anyone in business would be like, should I measure a return on investment on this? What should my expectations be? What are my metrics? How do I measure any form of success here? Are these tangible or intangible?

So organic social media is quite hard to find out where the leads come from, just purely because it might be that they have seen five of your posts over the last six months, and then one piece of content makes them pick up the phone. Now, you can’t put it down to one specific post that made them really get to like you and pick up the phone.

It might be the last one, but it might have been one three months ago that you talked about remortgaging, and then they saw your name again this week and went, I need to get in touch with them. It’s hard to say the return on investment on those ten posts, but what I would say is the growth of the audience.

So your growth of audience is about 30% a year. You should expect your audience to go up by 30% a year. But it’s more when you ask the people who book the appointment, where have you seen us? And what you’ll find, a lot of people will go, I’ve seen you on social media.

Even if they’ve been referred by a friend. Remember, let’s go back to the garden landscape analogy. They’ve been referred by a friend, checked out your socials and that’s reaffirmed that they should phone you. So it’s really hard to measure that. It’s like billboards.

You could never say, I’m going to spend five grand on a billboard. Does it bring me five grand’s worth of business? You don’t know. You can say, yes, people have noticed your billboard, but was that a direct correlation to them phoning you and booking a mortgage appointment?

I think you separate brand and sales, which is important. Quite a few people in operations might set anything from 5% to 20% of their marketing budget for brand. And it might not even be that you do it that way. It might even be your time management. It might be that you say, right, actually, I need sales. Could be looking for more B to B referrals, could be looking at my word-of-mouth recommendations, reaching out to past clients, and might be a newsletter to clients in that way. It could be time or budget management because as you say, it’s really difficult for people to put all their eggs in one basket when what they really want is immediate sales, where that’s what they want, and they want to measure the ROI on that.

There might be other paid media that is better for them. Pay-per-click is an example, whereas as you referenced in those case studies, particularly with Redditch, the sheer percentage of work that they’re getting from social shows that you need to be planting the seeds. And then when that rainy day comes, whether it be that the cost of paid media is too expensive, losing referrals, whatever, you’ve got this more organic, more long-term, more stable arm of your business in terms of referrals and marketing there.

Some people might say it should be more 50/50%. Some people might say 80/20%. Some people might say 90/10%. I guess that each person is going to be different, let alone each industry in that regard.

I know exactly what you mean. If you think of the Coca-Cola advert at Christmas, okay, there’s no call to action on that, there’s no “drink coke” or “drink coke at Christmas”. They run that advert every year purely from a brand’s perspective. How many people speak about that advert every year?

The John Lewis Advert. They do a TV advert every year, which just goes everywhere. Not once do they advertise a product that they’re selling in that advert. I remember last year, it was like a skateboard. I don’t think they’ve sold a skateboard in probably 50 years. But that’s the whole point of it.

Those posts, you could never say that there’s a direct correlation between doing the John Lewis advert and how many sales we got off it. But we know it worked because it’s got everybody talking or it’s made you think of John Lewis.

What are some of the common mistakes mortgage brokers make when it comes to social media marketing?

The biggest mistake is not doing it. That’s the biggest one.

The second one is at the beginning, saying that we need more likes, we need more comments, we need more engagement. I would say the first thing that you need to do is to get your family and friends to like the page.

The engagement will come further down the line. But don’t put too much ethos on or too much focus on the likes and the comments of your posts.

You could have 1000 people see a post, 100 like it, and nobody gets in touch yet, you could have 50 followers, 20 of them see a post about getting in touch with us six months before your rate ends and three of those 50 call you up.

That, to me, is much more powerful than having 100 likes on a post. So don’t worry too much about the figures.

The other thing to do is to avoid putting links on posts. The way that social media works is they want to keep their users on the platform for as long as possible because they want to sell them adverts for other products or they want to push an agenda.

If you put a link on a social media post, what you’re saying to Facebook is, I want to take your user away from Facebook and onto my platform or onto my website. So Facebook will not push that post out to more people because they don’t want it put in front of people.

Another mistake I come across is that people worry too much about what others are going to think of them on social media. I know that’s a really sweeping generalisation. The first thing is nobody cares. Everybody’s too worried about themselves when they see your post.

I’ll be honest, it’s going to be lost in the stratosphere within 24 hours anyway because there’s so much noise on social media. If you upload a photo of your face, they’re probably going to forget it in 24 to 48 hours day.

If you are hesitant to do a video or upload a photo of yourself because you think people might ridicule you for it, what you’ll actually find is it’s the opposite. People will admire you for doing it and you’ll probably get a few messages saying fair play, or I’d never have done that. It’s the people saying to you that I’d never have done that and it’s fantastic that you have.

So don’t worry too much about figures. Don’t put links within the post, and don’t worry about what other people are going to think about it, because more than likely they’ll actually admire you for what you’re doing if you put yourself out there on social media.

On the links point, Chris, is it just no links at all, or would people put the links in the comments below and we can put a link in there? Would that still impact things negatively?

Sometimes you have to put links/sources to articles, if you want to navigate them to a particular page on your website. Yes, you have to do it. But if you can try and avoid it, like LinkedIn, for example, you can put the links in the comments.

A gentleman did loads of research into LinkedIn and he said if it’s after half an hour, you’re OK to put the links in. So don’t post the link in the comments for the first half hour, but after that it’s fine. If you put it in within that half an hour, it will really hamper the reach of your post.

Do you think there’s going to be much change over the next six to twelve months in terms of some of the social platforms? People have been talking about Threads, and different social platforms emerging. Are there other technologies or other methods of content creation that you think mortgage brokers might need to be aware of or keep an eye on?

There is Threads, which is essentially what Twitter or X is. Threads is a great way to connect with your audience on a personal level or a customer service level because you can type something really quick and you can engage with people.

Threads was massive in July when it was launched. Huge. Everyone was on it. Now it’s died a bit of a death, so I don’t know if it’s going to come back. Similar to Clubhouse. Clubhouse was another big one. Everyone was on it. Does anybody talk about Clubhouse anymore? I think Threads will stand the test of time because it’s linked to Instagram and they’ll have that budget and that market to be able to do it. Artificial intelligence is the next thing that people are talking about.

So artificial intelligence, yes. AI can create content for you and do it all for you. But think about it. Why are people coming to you as a business? Are they coming to you because you write a really good blog post, or do they love the way that you write a social media post? Or are they coming to you because you’re giving them really informative content and you’re talking about it from a personal point of view?

So you could do a case study to say you helped Mr. And Mrs. Smith secure their remortgage when five banks said no, that’s the reason they’d use you, not because an AI bot wrote you a post about how effective remortgaging can be. See the difference between them? So AI is a big conversation at the moment, but I think social media will put things in place to stop artificial intelligence-generated content ranking higher than content that you write yourself.

I think it is handy to search for hashtags relevant to your business and see what others are doing. I think if you can find a style of whatever it is that they do that works for you that you like that helps a lot.

There might be some people who write, like you said, there might be some people who prefer doing images. They might even want to do a voiceover, and then there are other people who are just quite happy just getting the camera out and just being on camera and ad-libbing.

You want to do what comes naturally. Ultimately, it might always feel like a bee sting doing content, but ideally you don’t want it to be a sting at all. You want to sort of enjoy doing it as much as you can, even if it’s just a distraction from the grind of chasing lenders this whole time dealing with rates.

I’m glad you said that because even though we’re talking about how to use TikTok and how to use all these trends, you’ve just got to approach every channel as you. The perfect example, and I’m going to talk about two different approaches here to TikTok. Go and have a look at Glenn Russell, he does funny TikToks.

He creates characters with glasses on and scarves and talks about mortgages in that way. And it’s a bit like it’s fun and it’s out there. He’s got a great audience.

You go and look at Anish Patel, who’s on TikTok as well. Same channel, but formative content. So he does video-to-face walking down the street.

What is a buy-to-let mortgage? How much deposit do I need to buy a house?

Two very different approaches, but two very successful people on TikTok. And it just goes to show you, there’s not one size fits all for any social media channel. I’m sitting here telling people what to do but that might not fit you.

You might not want to do a video, you might not want to engage, and you might find another way to win on social. But exactly like Sean had said there, find the approach that fits well for you on social media. Some people use their kids with photos and family photos. Other people don’t like uploading photos of their kids on social media, but they still do very well.

There’s not one size fits all when it comes to social. Just follow the guidelines that I’ve said here and then go and put your own stamp on it.

Podcasts. If you’re this way inclined, I wouldn’t put anyone off setting up their own property podcast in their area. Whether they do it once a week, or once a month is up to them. I’m thinking about it from the post-production point of view and the lead gen point.

Rather than you going out to all the estate agents in the area and other areas, and even accountants and so forth, wanting to try and get referrals from them, if you can invite them onto the show, give them a shout-out in your local property channel, you’re far more likely to build a rapport and get the chance to talk about business on that.

But from a content point of view, if you really wanted to post produce on it, you’ll get your YouTube show out of it, the podcast out of it. You’d then be able to get your transcript and do a blog out of it for your website, and clips for your other social channels.

What is the guest going to do that’s on the show? They’re going to share those clips, share that information across their own audience, and especially if it’s a location property channel, depending on how wide you want to try and make that regional town, I guess I think that’s something that can definitely help you with your content ideas because you might be able to say, hey, we have Lenny from the local estate agents is coming on our property show this week.

There’s the build-up to it, there’s the events itself, there’s then the clips and everything that goes out from it afterward with some of the other content pieces. I think that’s something that people would have to do a bit of research on, that, I guess, in terms of feeling comfortable that they’re using the right software and whatever to make it happen.

But it doesn’t have to be crystal clear sound quality and heavily produced at the time to make that a success.

No. And just to show you how easy it is, because I never knew about podcasts, we’ve got a podcast on Social For Brokers. I zoom it with people.

I automatically upload it to YouTube. I don’t edit it, I just press record. I upload it to my podcasts. There’s no editing, there’s no time involved.

We’ve had nearly 15,000 downloads now. You don’t need to overthink these things, because I nearly did at the beginning, I thought, you know what, I’m just going to upload it to YouTube and see how it gets on.

Yes, I could do a lot more to edit it and try and get up in the rankings and stuff, but it serves a purpose for me. So try not to overcomplicate. That’s my very similar message on social media. Don’t overcomplicate that social media content creation. Don’t overcomplicate a YouTube video.

Get into the habit of uploading first, and then you can tweak it further down the line.

Are there any specific compliance or regulatory considerations that mortgage brokers need to be aware of before using social media for marketing?

Always double-check with your compliance department. It will always depend on your network if you need to get them signed off, or you can get a social media licence or they review your channels.

Obviously, consumer duty coming in the middle of 2023. That was obviously a big thing that changed the language that you can use on social media. So always double-check with your compliance, especially when it comes to video, because it’s a lot harder to police the video side of it because there are no actual written words.

So double double-check with compliance. I’d always say don’t make any concrete promises on your social media. It becomes a bit of a minefield when you start talking about products and rates, because as we all know, they can be pulled as quickly as they appear at the moment.

Double-check with your compliance department first and make sure you’ve got the right disclaimers and things on your posts.

Anyone who’s interested in reaching out to you, Chris, to get your advice and support with their social media marketing for their mortgage broker business, how would they go about getting in touch with you? What can they kind of expect when they reach out to you? What do you do in terms of discussing with them, what does working with you look like?

You can reach me on any of the social media channels. So we’re on Facebook, Instagram, LinkedIn, TikTok, just search for “social for brokers”. Or you can Google us and read our reviews.

What we do to start with is book a social media strategy call. Let’s hear what you want to do. Let’s find out how you want to attract new clients. What you’re struggling with. Is it time? Is it knowledge? Is it strategy? We can help with it all.

We know this industry inside out, so we will know which area to point you in the direction of, and we’ll talk about how we can help you with your content, with your website, with your blogs, with your emails, whatever it might be. Get in touch and we can help.

Unique Conveyancing Alternative For Mortgage Brokers & Estate Agents

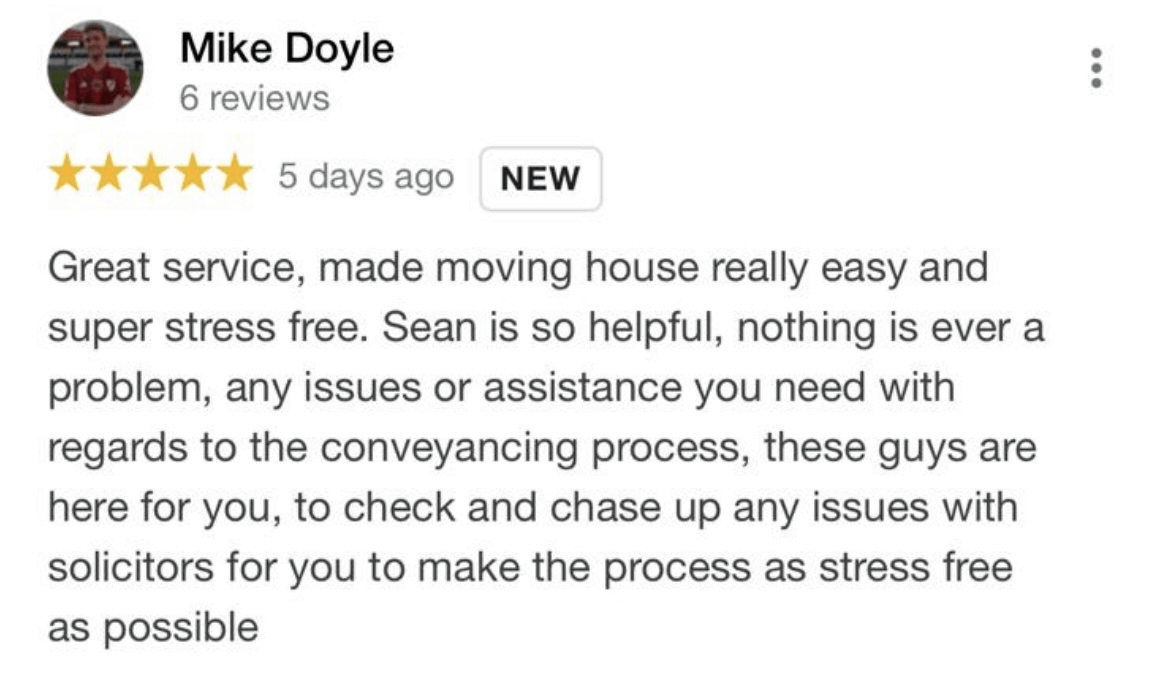

We operate a FREE to-access unique conveyancing service for mortgage brokers & estate agents.

We work successfully with over 300 brokers & agents nationwide.

– 5* Service & communication focused

– Conveyancing firms cherry-picked

– Fee earners in each firm pre-vetted, interviewed, and ring-fenced for you

– Updates include “what is outstanding and from whom” without you needing to ask

– Higher referral fees available & faster payment service assisting cashflow

– Stringent SLA’s signed by the conveyancing firms and available to view in our portal to remove any grey areas if service is questioned

– Mediation service for clients if any issues occur with a 5* hands on support service if and when challenges arise

– Compliance & brand protection

Happy Clients

We pride ourselves on our personal service

Contact My Legal Club

Additional Blogs That May Assist You

The content of the blog, podcast, video, and/or show is for information purposes only, and does not constitute advice.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT. IF YOU ARE THINKING OF CONSOLIDATING EXISTING BORROWING YOU SHOULD BE AWARE THAT YOU MAY BE EXTENDING THE TERMS OF THE DEBT AND INCREASING THE TOTAL AMOUNT YOU REPAY. SOME BUY-TO-LET MORTGAGES ARE NOT REGULATED BY THE FCA. EQUITY RELEASED FROM YOUR HOME WILL ALSO BE SECURED AGAINST IT.