Settlement Agreements Guide

Settlement Agreements Guide for employees.

Below you will find a full factsheet on Settlement Agreements providing you with everything you need to know about Settlement Agreements.

Our leading experienced employment solicitor partner is on hand to support you, review your circumstances, advise, and calculate your Settlement Agreement.

Settlement Agreement Legal Advice

We partner with leading, regulated, expert settlement agreement employment law solicitors.

If you would benefit from independent legal advice, with no-obligation, please do not hesitate to get in touch.

Settlement Agreement Factsheet

The factsheet below is our guide on Settlement Agreements. Click on a heading below that sparks your interest to learn more:

By Aliyah Rahman

WHAT IS A SETTLEMENT AGREEMENT?

WHAT DOES A SETTLEMENT AGREEMENT INVOLVE?

HOW MUCH DOES A SETTLEMENT AGREEMENT COST?

HOW MUCH TIME WOULD LEGAL ACTION TAKE?

THE ADVANTAGES AND DISADVANTAGES OF USING SETTLEMENT AGREEMENTS

WHAT HAPPENS IF I REFUSE A SETTLEMENT AGREEMENT?

DOES A SETTLEMENT AGREEMENT AFFECT FUTURE EMPLOYMENT?

IS A SETTLEMENT AGREEMENT BETTER THAN REDUNDANCY?

DO I NEED A SOLICITOR FOR A SETTLEMENT AGREEMENT?

WHO IS CLASSED AS AN INDEPENDENT ADVISER?

HOW MANY FORMS OF SETTLEMENT AGREEMENTS ARE THERE?

LETTERS TO START A SETTLEMENT DISCUSSION?

CALCULATING A SETTLEMENT AMOUNT

SHOULD I AGREE TO A SETTLEMENT AGREEMENT?

WHY HAVE I BEEN OFFERED A SETTLEMENT AGREEMENT?

WHAT IS A REASONABLE AMOUNT FOR A SETTLEMENT AGREEMENT?

ARE THERE ANY RESTRICTIVE COVENANTS IN YOUR AGREEMENT?

DO I HAVE TO PAY TAX ON MY SETTLEMENT AGREEMENT?

A settlement agreement is a legally binding agreement between an employee and employer (it was formerly known as a compromise agreement).

This is usually a document agreed and signed between an employee and employer either before termination of the employment contract or after the termination of an employment contract. A settlement agreement is used to prevent employees from bringing any claims for wrongful dismissal or breach of contract by the employer.

WHAT DOES A SETTLEMENT AGREEMENT INVOLVE?

A settlement agreement may include your employer offering to pay you a sum of money, stop treating you unlawfully, or both.

When going through a settlement agreement it usually includes the following:

– All payments due to the employee

– Confirmation as to tax (usually payments up to £30,000.00 and this can be paid without any deduction)

– Confirmation that an employee cannot bring a claim against the employer

– Sometimes there are limited covenants such as an employee cannot set up the same business in the near future, approach staff or make any bad remarks about the employer

– In, many situations a reference will be agreed for the employee’s benefit in finding a new job

HOW MUCH DOES A SETTLEMENT AGREEMENT COST?

Between £350-£500 + VAT on average HOWEVER the fee is paid by your employer.

The employer is responsible to pay for the settlement agreement and the legal advice that was offered by a solicitor.

There is no definite timeframe. However, the amount of time it takes to negotiate and get the settlement agreement signed varies depending on the case-by-case basis.

For instance, the agreement can be finished in a few days if your solicitor suggests you accept it as is. Alternatively, if you want to negotiate and make modifications, it may take longer.

THE ADVANTAGES AND DISADVANTAGES OF USING SETTLEMENT AGREEMENTS

Advantages of Agreeing to a Settlement Agreement:

1) Financial Compensation:

Advantage: One of the primary benefits of a settlement agreement is the financial compensation provided to the employee. This lump sum or structured payment can often be more favorable than potential outcomes in employment tribunals. It provides a sense of financial security during the transition period.

2) Confidentiality and Reputation Protection:

Advantage: Settlement agreements commonly include confidentiality clauses. This ensures that details of the dispute and the terms of the agreement remain private. For the employee, this can be crucial in protecting their professional reputation, as the reasons for the separation are not disclosed publicly.

3) Quick Resolution and Avoidance of Legal Proceedings:

Advantage: Settlement agreements offer a swift resolution to employment disputes. This can save considerable time and energy compared to lengthy legal battles. Avoiding the stress and uncertainty of a tribunal hearing may contribute to a quicker recovery and the ability to move on to new opportunities sooner.

Disadvantages of Agreeing to a Settlement Agreement:

1) Financial Trade-Off:

Disadvantage: While financial compensation is a benefit, employees may receive less than they might have obtained through legal proceedings. In the interest of a swift resolution, individuals might agree to terms that undervalue their claims or potential entitlements, sacrificing some financial gain for immediate closure.

2) Restrictions on Future Employment:

Disadvantage: Settlement agreements often contain restrictive covenants that limit the employee’s ability to work in similar roles or industries for a specified period. This can hinder career progression and limit job opportunities, affecting the individual’s professional growth after leaving the current employment.

3) Impact on Emotional Well-being:

Disadvantage: Agreeing to a settlement agreement can be emotionally challenging. The process of negotiation and the acknowledgment of the end of the employment relationship can be stressful. Additionally, the confidentiality clause may prevent the employee from openly discussing their experience, potentially limiting their ability to seek emotional support from colleagues or friends.

It’s important to note that the specific terms of settlement agreements can vary, and individuals should seek legal advice to ensure they fully understand the implications of the agreement they are considering.

You can still file a claim against the employer with an employment tribunal if you decide not to sign a settlement agreement. If the likelihood of obtaining a pay-out that’s greater than what your employer is willing to provide you are favourable, then it might be worth it.

Typically, signing a settlement agreement won’t prevent you from getting employment elsewhere. But certain contracts might have clauses that prohibit you from working for a different company for a predetermined amount of time.

Yes. With the assistance of a solicitor, the employee can negotiate the terms of the settlement agreement and decide whether to accept it, giving them a degree of control and assurance. However, for employees, mandatory redundancy is frequently a tense, unpredictable, and protracted process.

Yes. It is legally required to obtain expert guidance before creating an employment settlement agreement. This is because a settlement agreement must be examined and signed by a qualified solicitor to be considered legal. The legal advisor must be identified and insured.

WHO IS CLASSED AS AN INDEPENDENT ADVISER?

An independent adviser can be:

- A Qualified Lawyer.

- A certified and authorised officer, official, employee or member of an independent trade union.

- A certified and authorised advice centre worker.

HOW MANY FORMS OF SETTLEMENT AGREEMENTS ARE THERE?

Two.

The two forms of a settlement agreement include:

- an agreement leading to termination, and

- an agreement that does not lead to termination.

LETTERS TO START A SETTLEMENT DISCUSSION?

Under s111A of the Employment Rights Act 1996 there are template letters to initiate settlement disputes. They can be used when there has been a disciplinary or performance procedure or when there’s been no disciplinary or performance procedure. For more information about these letter’s they can be found on the ACAS website.

CALCULATING A SETTLEMENT AMOUNT

There are a few factors that will need to be considered when deciding how much to compensate employees such as:

- The clauses in the employment contract that relate to pay, notice periods and any untaken annual leave.

- Duration of employment.

- How long might the case take to get resolved if a settlement cannot be reached.

- The, ease with which the employee can be replaced.

- Why an offer of settlement is being made.

- If an agreement cannot be reached, the cost of any future employment tribunal or court proceedings against the employer.

You can expect to receive a pay-out that is equivalent to between 3 and 6 months of your salary in addition to any notice pay and accrued holiday pay.

Your notice pay is calculated using the average of your weekly earnings over the previous 12 weeks.

Annual leave begins to accumulate (‘accrue’) as soon as a worker begins work. This is usually 5.6 weeks’ paid holiday a year.

SHOULD I AGREE TO A SETTLEMENT AGREEMENT?

Understanding the Settlement Agreement

A settlement agreement is a legally binding contract that outlines the terms and conditions agreed upon by parties to resolve a dispute. Typically, it involves one party making a payment or providing some form of consideration in exchange for the other party releasing all claims related to the dispute. While settlement agreements can bring closure to legal matters, individuals must be aware of their rights, the implications of accepting the agreement, and the broader legal context.

Key Considerations

1. Legal Rights and Claims:

Before agreeing to a settlement, it is crucial to assess the strength of your legal rights and claims. Understanding the merits of your case empowers you to negotiate favourable terms. Seek legal advice to evaluate the strengths and weaknesses of your position, ensuring that the settlement aligns with your best interests.

2. Terms and Conditions:

Scrutinizing the terms and conditions of a settlement agreement is imperative. These may include financial compensation, confidentiality clauses, non-disclosure agreements, and other provisions. Ensure that the terms are clear, fair, and address your concerns. If necessary, seek clarification or negotiate modifications to better protect your interests.

3. Future Legal Recourse:

Accepting a settlement often involves waiving the right to pursue further legal action related to the dispute. Consider whether you are comfortable forfeiting the possibility of seeking redress through the courts. If the settlement is comprehensive and addresses your concerns adequately, foregoing future legal action may be a reasonable decision.

4. Costs and Time:

Litigation can be time-consuming and expensive. A settlement may provide a quicker resolution and potentially reduce legal costs. However, it is essential to balance the advantages of a swift resolution against the potential benefits of pursuing a case through the tribunal system. Evaluating the overall cost-benefit analysis is essential in making an informed decision.

5. Legal Advice:

Seeking legal advice is a fundamental step in the decision-making process. A qualified lawyer can provide insights into the legal implications of the settlement agreement, ensuring that you understand the consequences and potential risks.

In essence, the answer to whether one should agree to a settlement agreement depends on a nuanced analysis of the specific circumstances, legal considerations, and individual priorities.

By approaching the decision with a thorough understanding of the legal landscape, individuals can make choices that are both informed and aligned with their best interests.

WHY HAVE I BEEN OFFERED A SETTLEMENT AGREEMENT?

1. Termination of Employment

One of the most common scenarios leading to the offer of a settlement agreement is the termination of employment. Employers may propose such agreements as a means of resolving potential disputes or claims that may arise from the termination. This proactive approach aims to provide both parties with a clear and legally sound resolution, minimizing the risk of costly and time-consuming litigation.

2. Protection for Employers

Settlement agreements offer a level of protection for employers by securing their interests and preventing former employees from pursuing legal action. By agreeing to a settlement, employees often waive their right to bring claims against the employer, such as unfair dismissal, discrimination, or breach of contract. This protection is particularly valuable for employers seeking to avoid the uncertainties and potential reputational damage associated with employment-related disputes.

3. Confidentiality and Non-Disclosure

Another significant aspect of settlement agreement is the inclusion of confidentiality and non-disclosure clauses. Employers may insist on these provisions to safeguard sensitive information, trade secrets, or proprietary knowledge. In exchange for a financial settlement, employees are often required to keep the details of the agreement confidential. This not only protects the employer’s interests but also allows for a smoother transition for both parties.

4. Financial Considerations

Financial considerations are a pivotal element of settlement agreements. Employers may offer a financial settlement as compensation for the termination of employment, potential claims, or other factors. The amount offered is typically negotiated between the parties, taking into account various factors such as the employee’s length of service, salary, and the potential strength of any legal claims. It is crucial for individuals to carefully assess the financial terms of the settlement and, if necessary, seek legal advice to ensure they are receiving a fair and equitable offer.

5. Tax Implications

Understanding the tax implications of a settlement agreement is essential for both parties involved. While statutory redundancy pay is usually tax-free up to a certain limit, other elements of a settlement may be subject to taxation. It is advisable for individuals to seek guidance from a tax professional to ensure compliance with applicable tax laws and to avoid any unexpected financial consequences.

6. Legal Advice and Consideration Period

English law mandates that individuals receiving a settlement agreement must seek independent legal advice before signing. This requirement aims to ensure that individuals fully comprehend the legal implications of the agreement and are not coerced into accepting unfavourable terms. Additionally, individuals are granted a reasonable period to consider the offer, during which the agreement is typically open for acceptance.

In conclusion, the offer of a settlement agreement often arises in the context of employment termination, providing a legal framework for both employers and employees to resolve disputes and move forward. These agreements offer protection to employers, provide financial compensation to employees, and establish clear terms for the conclusion of the employment relationship.

It is crucial for individuals presented with a settlement agreement to seek independent legal advice, carefully evaluate the terms, and consider the broader legal and financial implications before making a decision.

By understanding the intricacies of settlement agreements, individuals can navigate this legal process with greater confidence and make informed choices that align with their best interests.

You can expect to receive a pay-out that is equivalent to between 3 and 6 months of your salary in addition to any notice pay and accrued holiday pay. There are other factors that would influence the settlement figure.

Factors Influencing Settlement Agreement Calculations:

1. Strength of Legal Claims:

The perceived strength of each party’s legal claims is a fundamental factor in settlement negotiations. If one party has a strong case with substantial evidence supporting their position, they may have a stronger bargaining position and be entitled to a higher settlement amount.

2. Legal Costs:

Settlement agreements often take into account the potential expenses associated with protracted litigation. A reasonable settlement amount may include provisions for covering legal costs incurred by both parties.

3. Risk and Uncertainty:

The inherent risks and uncertainties associated with litigation are crucial considerations in settlement negotiations. The prospect of an unpredictable court outcome may motivate parties to reach a settlement that provides a degree of certainty, even if it means compromising on certain aspects of their claims.

4. Economic Damages:

In cases involving financial compensation, the calculation of economic damages plays a pivotal role in determining a reasonable settlement amount. This may involve assessing direct financial losses, lost profits, or any other quantifiable economic harm suffered by the aggrieved party.

5. Non-Economic Factors:

Settlement agreements may extend beyond purely monetary considerations. Non-economic factors, such as reputational damage, business relationships, or other intangible concerns, can influence the negotiation process. Parties may be willing to compromise on financial terms to secure favourable non-monetary outcomes.

6. Precedents and Case Law:

Parties and their legal representatives often refer to past judgments to gauge the likely outcomes of their case in court. Settlement amounts may be influenced by established legal principles and decisions in similar cases.

7. Public Interest:

In certain cases, the public interest may be a factor in determining a reasonable settlement amount. This is particularly relevant in cases involving regulatory compliance, environmental issues, or matters of significant public concern.

The determination of a reasonable settlement amount in English law is a highly intricate process that involves a careful weighing of multiple factors.

Legal professionals, when advising their clients, must conduct a thorough analysis of the specific circumstances surrounding the dispute to arrive at a settlement amount that reflects the interests and rights of all parties involved.

ARE THERE ANY RESTRICTIVE COVENANTS IN YOUR AGREEMENT?

1. Defining Restrictive Covenants

Restrictive covenants are clauses within a contract that impose limitations on the actions of one or more parties.

These restrictions are designed to safeguard the interests of the parties involved and may take various forms, including non-compete clauses, non-solicitation clauses, and confidentiality clauses.

Non-compete clauses prohibit a party from engaging in activities that directly compete with the other party’s business. Non-solicitation clauses, on the other hand, restrict the solicitation of employees, clients, or suppliers for a specified period after the termination of the agreement.

Confidentiality clauses, as the name suggests, aim to protect sensitive information shared between the parties.

2. Enforceability of Restrictive Covenants

While restrictive covenants serve legitimate purposes, their enforceability is subject to scrutiny by English courts. The courts apply a reasonableness test to determine whether the restrictions imposed by a covenant are fair and proportionate. This test considers factors such as the geographical scope, duration, and the legitimate business interests that the covenant seeks to protect.

- Geographical Scope: A restrictive covenant must define the geographical area to which it applies. Courts are more likely to enforce covenants with reasonable geographic restrictions that are directly tied to the parties’ business interests.

- Duration: The timeframe for which a restrictive covenant remains in force is a crucial factor. Courts assess whether the duration is reasonable based on the nature of the industry and the time required to protect the specified business interests.

- Legitimate Business Interests: To be enforceable, a restrictive covenant must serve a legitimate business interest, such as protecting trade secrets, client relationships, or goodwill. A covenant that goes beyond safeguarding these interests may be deemed unreasonable and unenforceable.

3. Drafting Considerations

Parties should approach their inclusion in agreements with precision and care. When drafting such clauses, it is essential to clearly define the scope of the restrictions and ensure that they align with the specific needs and circumstances of the parties involved.

Moreover, parties should consider incorporating severance clauses, which stipulate that if one part of the covenant is deemed unenforceable, the remainder remains in effect. This can provide a safety net in case any aspect of the covenant is challenged in court.

In conclusion, the presence of restrictive covenants in an agreement adds a layer of complexity to contractual relationships. Parties must ensure that such clauses are not only well-drafted but also aligned with the reasonableness standards set by English courts.

By understanding the intricacies of restrictive covenants and approaching their inclusion thoughtfully, parties can enhance the enforceability of their agreements while safeguarding their respective interests in the ever-evolving business environment.

The taxation of settlement agreements depends on the nature of the compensation received. Generally, the following principles apply:

Statutory Redundancy Pay:

Statutory redundancy pay is tax-free up to a certain limit. Any amount exceeding this limit may be subject to income tax.

Compensation for Loss of Employment:

Payments specifically related to the termination of employment, such as compensation for loss of office, are typically taxable as earnings.

Ex-Gratia Payments:

Ex-gratia payments (payments made without any legal obligation) up to £30,000 are usually tax-free. Any amount above this threshold may be subject to income tax.

Payment in Lieu of Notice (PILON):

PILON is generally subject to income tax and National Insurance contributions. However, if there is a contractual PILON clause in the employment contract, it will be fully taxable, regardless of the amount.

Other Benefits:

Non-cash benefits or benefits in kind provided as part of the settlement may also have tax implications.

It is crucial to note that tax laws can be complex and subject to change. It is advisable to seek professional advice, such as consulting with a tax advisor or HM Revenue & Customs (HMRC), to ensure accurate and up-to-date information tailored to your specific situation.

Failure to report taxable income may result in penalties, so it’s important to understand the tax implications of your settlement agreement.

This response provides a general overview, and individuals should consult with a tax professional for advice specific to their circumstances.

Settlement Agreement Legal Advice

We partner with leading, regulated, expert settlement agreement employment law solicitors.

If you would benefit from independent legal advice, with no-obligation, please do not hesitate to get in touch.

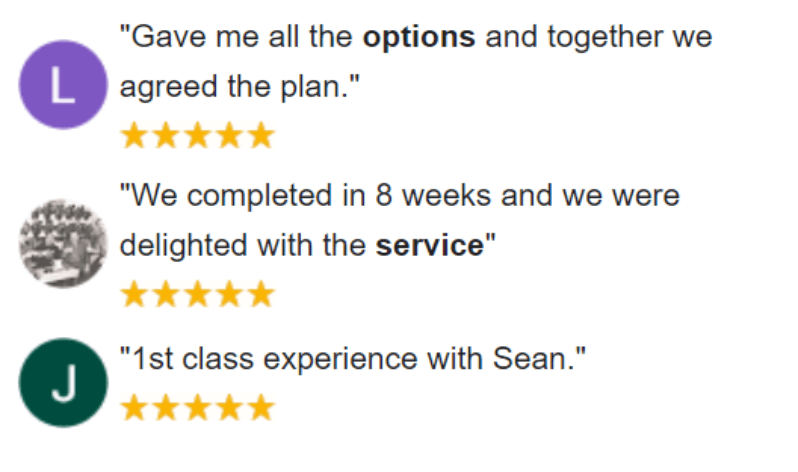

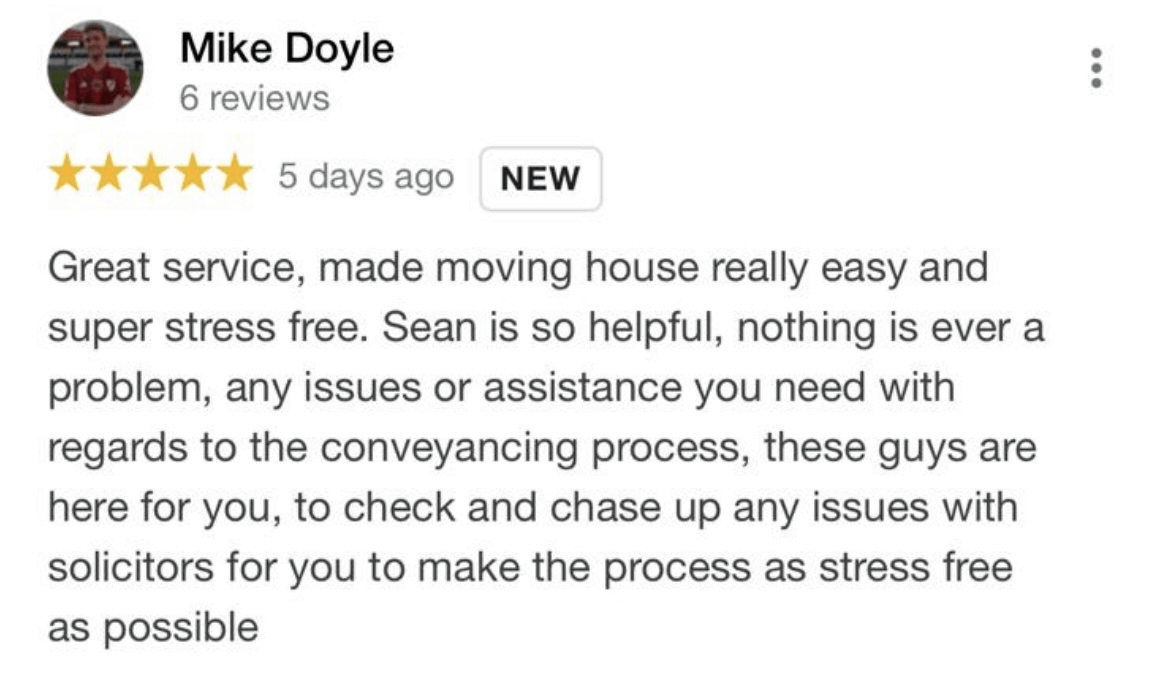

Happy Clients

We pride ourselves on our personal service

Contact My Legal Club

Additional Blogs That May Assist You

The content of the blog, podcast, video, and/or show is for information purposes only, and does not constitute advice.