Settlement Agreement Solicitors

Settlement Agreement Specialist

Your Employer Pays

Same Day 5* Google Service

Leading Employment Solicitor

Settlement Agreement Solicitors

Settlement agreement solicitor David Brown is one of the leading and most experienced solicitors in the country.

Benefit from his expertise, 5* same day service, and settlement agreement advice with no cost to you.

David is not just a general solicitor who happens to want to sign off an agreement. David has over 20 years experience as a leading settlement agreement solicitor.

David can advise and sign-off on your settlement agreement swiftly and correctly leaving you with 100% peace of mind.

David Brown Solicitor

Fast and simple process

Get In Touch

Complete our enquiry form to get started with no-obligation!

Same-day Advice

Get in touch and you will hear from David the same working day!

Employer Pays

Sign-off

5* advice, negotiation, and sign-off from 20+ years experienced solicitor

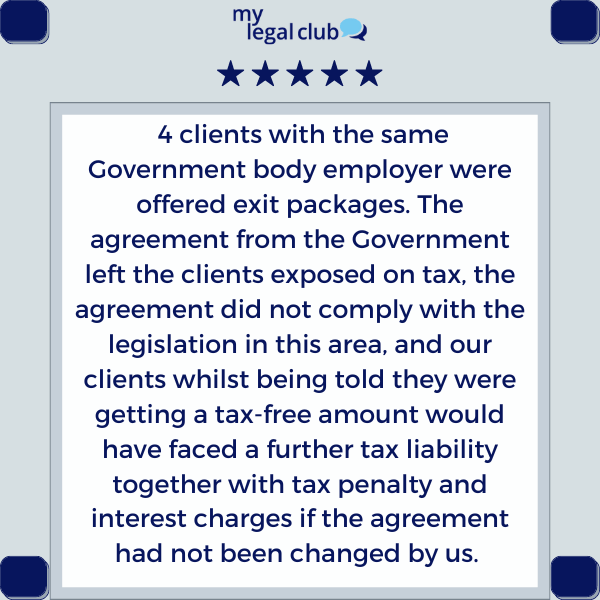

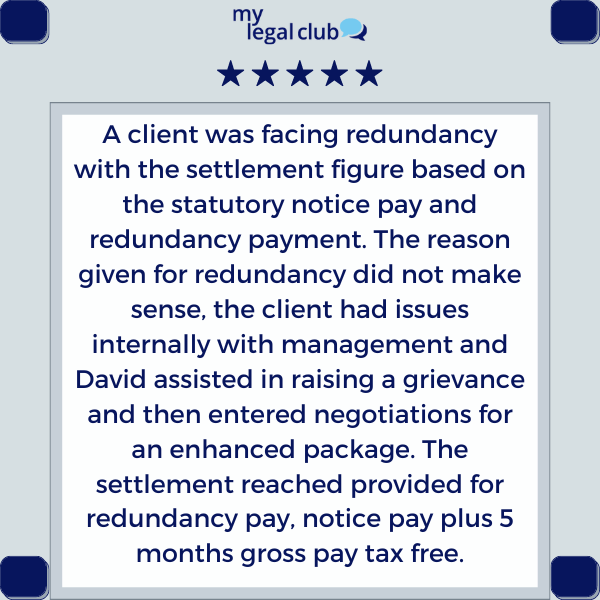

Case Studies

Advice & Sign-Off

David is a specialist settlement agreement solicitor who will quickly advise and sign off on your settlement agreement.

A nationwide service and David can advise you by telephone.

You can sign your agreement via e-signature completing the process from the comfort of your own home at a time that suits you.

David handles everything with your employer so it is 100% stress-free for you.

Your employer pays meaning the service is NO COST TO YOU*.

David is highly experienced, highly rated by his clients and peers, and helps make the process as fast and simple as possible.

Why Choose David?

This is not a general solicitor who happens to want to sign off an agreement. David is a solicitor who specialises in employment law, representing both individuals and businesses, meaning a complete knowledge of the process and the position of each party, strenghtening your position.

Over 20 years experience in this area dealing with hundreds of settlement agreements a year, for all levels of employee.

Whilst these agreements are fairly standard, the small details are crucial, and with specialist knowledge in the area, expertise in settlement agreements, and vast experience he can make the necessary amendments to best protect and support your requirements before entering into the deal.

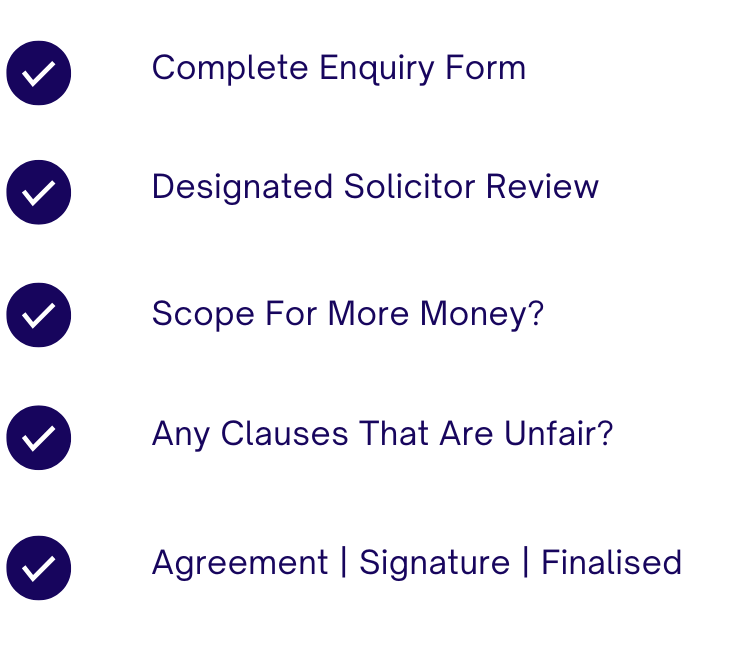

Simple Process

Step One: Complete the enquiry form on this page by scrolling down or hitting the “Get Started” button”

Step Two: David will review your case and advise you a) whether there is scope for more money and b) whether there are any factors you need to be concerned about and require amending before you sign any agreement. David will handle all dealings with your employer ensuring any negotiations work towards the deadline given.

Step Three: Once the final version of your settlement agreement has been received the signed settlement agreement will be sent to your employer for counter-signature, along with an invoice to cover your legal fees. Once counter-signed by your employer, your settlement agreement will be fully executed and legally binding.

FAQ & Queries

If you have any queries regarding the “Settlement Agreement Service” or queries regarding Settlement Agreements generally please check out the section below.

Click on a heading of interest to read more on the topic.

If your query is not answered below do not hesitate to get in touch!

What happens after I complete the enquiry form?

After you have completed the enquiry form you will automatically be sent an email confirming the next steps and introducing you to David directly. If you have the settlement agreement and/or your employment contract to hand you can reply to David and attach the same immediately. Do not worry if you do not have copies of these documents, either way, David will speak with you and advise you accordingly. David is a leading and experienced settlement agreement solicitor. Instructing David will reassure you and save you having to worry about settlement agreement solicitors.

*Free for you | Does my employer pay the legal fees to settlement agreement solicitors?

Yes. The starting position is that the employer pays the legal fees to settlement agreement solicitors. To have the agreement signed off the employer advises the employee they need to find an independent lawyer (settlement agreement solicitors) to provide the advice on the agreement, and the employer will make a payment towards those fees. Ideally, the agreement is fair, for the right amount of money, and it is a straightforward process. The agreement is signed and the settlement agreement solicitor invoices your employer for their fees.

Where your settlement agreement solicitors believe there is further negotiation required because there is scope for more money they will discuss this with you first. There are numerous funding options at that point the settlement agreement solicitors will discuss them with you before committing to anything.

It might be the fees paid by your employer are sufficient to cover this further negotiation, or it might be that these fees would be via a no win no fee agreement on any sum achieved over and above what is on offer, or it might be cost-effective to agree a set fee. All options will be discussed with you. The solicitor will also seek, where possible to get an increase in the legal fees contribution which can be offset against any fees. It could be that there is scope for more money, and that may require a highly experienced settlement agreement solicitor skilled in negotiating with employers to do the best job for you and discuss all options with you.

You need settlement agreement solicitors who pride themselves on working with you to ensure the best deal possible is secured.

Do you negotiate for me and take over all dealings with my employer?

Initially, they will review everything and advise you whether 1) the agreement and terms are fair and 2) the sum of money on offer is correct confirming whether there is any scope for negotiating more money.

All communications and any negotiations are handled by your solicitor providing you with a stress-free process and 100% peace of mind.

Why choose David as my solicitor?

When searching for Settlement Agreement Solicitors it is vital to select the right person not just the right solicitors firm. David Brown is not a general solicitor who happens to want to sign off an agreement. This is not a service operating a conveyor belt approach to agreeing and signing off settlement agreements without first having conducted a thorough, fast, and proper review to look after you and meet your needs quickly and effectively.

David is a solicitor who specialises in employment law, representing both individuals and businesses, meaning a complete knowledge of the process and the position of each party, strenghtening your position.

Over 20 years experience in this area dealing with hundreds of settlement agreements a year, for all levels of employee.

Whilst these agreements are fairly standard, the small details are crucial, and with specialist knowledge in the area, expertise in settlement agreements, and vast experience we can make the necessary amendments to best protect and support your requirements before entering into the deal.

What is a Settlement Agreement?

This is usually a document agreed upon and signed between an employee and employer either before the termination of the employment contract or after the termination of an employment contract. A settlement agreement is used to prevent employees from bringing any claims for wrongful dismissal or breach of contract by the employer.

A Settlement Agreement may be referenced in either other terms or alongside other phrases such as:

– ex gratia payment

– settlement payment

– termination payment

– payment in lieu of notice

– PILON payment

– protected conversation employer / employee leading to a settlement agreement

– Section 11A ERA conversation

– sacked payout

– dismissed pay-out sign

– enhanced payment

What does a Settlement Agreement involve?

A settlement agreement may include your employer offering to pay you a sum of money, stop treating you unlawfully, or both.

When going through a settlement agreement it usually includes the following:

– All payments due to the employee

– Confirmation as to tax (usually payments up to £30,000.00 and this can be paid without any deduction)

– Confirmation that an employee cannot bring a claim against the employer

– Sometimes there are limited covenants such as an employee cannot set up the same business in the near future, approach staff, or make any bad remarks about the employer

– In, many situations a reference will be agreed upon for the employee’s benefit in finding a new job

Settlement Agreement Solicitors will review everything and advise you accordingly to ensure everything is fair.

How much money will I receive as part of my settlement discussion?

There are a few factors that will need to be considered when deciding how much to compensate employees such as:

- The clauses in the employment contract that relate to pay, notice periods and any untaken annual leave.

- Duration of employment.

- How long might the case take to get resolved if a settlement cannot be reached.

- The ease with which the employee can be replaced.

- Why an offer of settlement is being made.

- If an agreement cannot be reached, the cost of any future employment tribunal or court proceedings against the employer.

Usually, you can expect to receive a minimum of your notice pay and accrued holiday pay. Any additional sums are very much dependent on the facts and circumstances but that is what you are engaging specialists for to be able to tell you what to expect and advise you on what is reasonable.

Your notice pay is calculated using the average of your weekly earnings over the previous 12 weeks.

Annual leave begins to accumulate (‘accrue’) as soon as a worker begins work. This is usually 5.6 weeks’ paid holiday a year.

Your settlement agreement solicitors will advise you on everything.

How much does a Settlement Agreement cost and who pays for it?

Between £350-£500 + VAT on average HOWEVER the fee is paid by your employer to your Settlement Agreement Solicitors. The employer is responsible for paying the reasonable costs to advise on the agreement. *

The employer is responsible for paying for the settlement agreement and the legal advice that was offered by the Settlement Agreement Solicitors.

How much time does legal action take?

There is no definite timeframe. However, the amount of time it takes to negotiate and get the settlement agreement signed varies depending on the case-by-case basis, led by Settlement Agreement Solicitors.

For instance, the agreement can be finished in a few days if your Settlement Agreement Solicitors suggests you accept it as is. Alternatively, if you want to negotiate and make modifications, it may take longer.

What are the advantages and disadvantages of a Settlement Agreement?

1) Financial Compensation:

Advantage: One of the primary benefits of a settlement agreement is the financial compensation provided to the employee. This lump sum or structured payment can often be more favorable than potential outcomes in employment tribunals. It provides a sense of financial security during the transition period.

2) Confidentiality and Reputation Protection:

Advantage: Settlement agreements commonly include confidentiality clauses. This ensures that details of the dispute and the terms of the agreement remain private. For the employee, this can be crucial in protecting their professional reputation, as the reasons for the separation are not disclosed publicly.

3) Quick Resolution and Avoidance of Legal Proceedings:

Advantage: Settlement agreements offer a swift resolution to employment disputes. This can save considerable time and energy compared to lengthy legal battles. Avoiding the stress and uncertainty of a tribunal hearing may contribute to a quicker recovery and the ability to move on to new opportunities sooner.

Disadvantages of Agreeing to a Settlement Agreement:

1) Financial Trade-Off:

Disadvantage: While financial compensation is a benefit, employees may receive less than they might have obtained through legal proceedings. In the interest of a swift resolution, individuals might agree to terms that undervalue their claims or potential entitlements, sacrificing some financial gain for immediate closure.

2) Restrictions on Future Employment:

Disadvantage: Settlement agreements often contain restrictive covenants that limit the employee’s ability to work in similar roles or industries for a specified period. This can hinder career progression and limit job opportunities, affecting the individual’s professional growth after leaving the current employment.

3) Impact on Emotional Well-being:

Disadvantage: Agreeing to a settlement agreement can be emotionally challenging. The process of negotiation and the acknowledgment of the end of the employment relationship can be stressful. Additionally, the confidentiality clause may prevent the employee from openly discussing their experience, potentially limiting their ability to seek emotional support from colleagues or friends.

It’s important to note that the specific terms of settlement agreements can vary, and individuals should seek legal advice to ensure they fully understand the implications of the agreement they are considering. We go in to more detail in our blog on Settlement Agreements

What happens if I refuse a Settlement Agreement?

You can potentially still file a claim against the employer with an employment tribunal if you decide not to sign a settlement agreement. If the likelihood of obtaining a pay-out that’s greater than what your employer is willing to provide you are favourable, then it might be worth it.

You would need to seek the advice of settlement agreement solicitors.

Does a Settlement Agreement affect future employment?

Typically, signing a settlement agreement won’t prevent you from getting employment elsewhere. However certain contracts might have clauses that prohibit you from working for a different company for a predetermined amount of time. This is why the advice of experienced settlement agreement solicitors is crucial.

Is a Settlement Agreement better than redundancy?

Yes. With the assistance of settlement agreement solicitors, the employee can negotiate the terms of the settlement agreement and decide whether to accept it, giving them a degree of control and assurance. However, for employees, mandatory redundancy is frequently a tense, unpredictable, and protracted process.

Do I need a solicitor for a Settlement Agreement?

Yes. Settlement agreement solicitors are crucial. It is legally required to obtain expert guidance before creating an employment settlement agreement. This is because a settlement agreement must be examined and signed by qualified settlement agreement solicitors to be considered legal. The settlement agreement solicitors and/or independent legal adviser must be identified and insured.

How many forms of Settlement Agreement are there?

Two.

The two forms of a settlement agreement include:

- an agreement leading to termination, and

- an agreement that does not lead to termination.

What letters are involved in starting the process for a settlement discussion?

Under s111A of the Employment Rights Act 1996, there are template letters to initiate settlement disputes. They can be used when there has been a disciplinary or performance procedure or when there’s been no disciplinary or performance procedure. For more information about these letters, they can be found on the ACAS website and your settlement agreement solicitors will advise you further.

Should I agree to a Settlement Agreement?

This is why the appointment of settlement agreement solicitors is so crucial. You will need to rely upon the advice and experience of your settlement agreement solicitors.

Understanding the Settlement Agreement

A settlement agreement is a legally binding contract that outlines the terms and conditions agreed upon by parties to resolve a dispute. Typically, it involves one party making a payment or providing some form of consideration in exchange for the other party releasing all claims related to the dispute. While settlement agreements can bring closure to legal matters, individuals must be aware of their rights, the implications of accepting the agreement, and the broader legal context.

Key Considerations

1. Legal Rights and Claims:

Before agreeing to a settlement, it is crucial to assess the strength of your legal rights and claims. Understanding the merits of your case empowers you to negotiate favourable terms. Seek legal advice to evaluate the strengths and weaknesses of your position, ensuring that the settlement aligns with your best interests.

2. Terms and Conditions:

Scrutinizing the terms and conditions of a settlement agreement is imperative. These may include financial compensation, confidentiality clauses, non-disclosure agreements, and other provisions. Ensure that the terms are clear, fair, and address your concerns. If necessary, seek clarification or negotiate modifications to better protect your interests.

3. Future Legal Recourse:

Accepting a settlement often involves waiving the right to pursue further legal action related to the dispute. Consider whether you are comfortable forfeiting the possibility of seeking redress through the courts. If the settlement is comprehensive and addresses your concerns adequately, foregoing future legal action may be a reasonable decision.

4. Costs and Time:

Litigation can be time-consuming and expensive. A settlement may provide a quicker resolution and potentially reduce legal costs. However, it is essential to balance the advantages of a swift resolution against the potential benefits of pursuing a case through the tribunal system. Evaluating the overall cost-benefit analysis is essential in making an informed decision.

5. Legal Advice:

Seeking legal advice is a fundamental step in the decision-making process. A qualified lawyer can provide insights into the legal implications of the settlement agreement, ensuring that you understand the consequences and potential risks.

In essence, the answer to whether one should agree to a settlement agreement depends on a nuanced analysis of the specific circumstances, legal considerations, and individual priorities. Selecting the right settlement agreement solicitors for you is critical.

By approaching the decision with a thorough understanding of the legal landscape, with specialist employment law advice, settlement agreement solicitors can help you make choices that are both informed and aligned with your best interests.

Why have I been offered a Settlement Agreement?

One of the most common scenarios leading to the offer of a settlement agreement is the termination of employment. Employers may propose such agreements as a means of resolving potential disputes or claims that may arise from the termination. This proactive approach aims to provide both parties with a clear and legally sound resolution, minimizing the risk of costly and time-consuming litigation.

2. Protection for Employers

Settlement agreements offer a level of protection for employers by securing their interests and preventing former employees from pursuing legal action. By agreeing to a settlement, employees often waive their right to bring claims against the employer, such as unfair dismissal, discrimination, or breach of contract. This protection is particularly valuable for employers seeking to avoid the uncertainties and potential reputational damage associated with employment-related disputes.

3. Confidentiality and Non-Disclosure

Another significant aspect of settlement agreement is the inclusion of confidentiality and non-disclosure clauses. Employers may insist on these provisions to safeguard sensitive information, trade secrets, or proprietary knowledge. In exchange for a financial settlement, employees are often required to keep the details of the agreement confidential. This not only protects the employer’s interests but also allows for a smoother transition for both parties.

4. Financial Considerations

Financial considerations are a pivotal element of settlement agreements. Employers may offer a financial settlement as compensation for the termination of employment, potential claims, or other factors. The amount offered is typically negotiated between the parties, taking into account various factors such as the employee’s length of service, salary, and the potential strength of any legal claims. It is crucial for individuals to carefully assess the financial terms of the settlement and, if necessary, seek legal advice to ensure they are receiving a fair and equitable offer.

5. Tax Implications

Understanding the tax implications of a settlement agreement is essential for both parties involved. While statutory redundancy pay is usually tax-free up to a certain limit, other elements of a settlement may be subject to taxation. It is advisable for individuals to seek guidance from a tax professional to ensure compliance with applicable tax laws and to avoid any unexpected financial consequences.

6. Legal Advice and Consideration Period

English law mandates that individuals receiving a settlement agreement must seek independent legal advice before signing. This requirement aims to ensure that individuals fully comprehend the legal implications of the agreement and are not coerced into accepting unfavourable terms. Additionally, individuals are granted a reasonable period to consider the offer, during which the agreement is typically open for acceptance.

In conclusion, the offer of a settlement agreement often arises in the context of employment termination, providing a legal framework for both employers and employees to resolve disputes and move forward. These agreements offer protection to employers, provide financial compensation to employees, and establish clear terms for the conclusion of the employment relationship.

It is crucial for individuals presented with a settlement agreement to seek independent legal advice, carefully evaluate the terms, and consider the broader legal and financial implications before making a decision.

By understanding the intricacies of settlement agreements, individuals can navigate this legal process with greater confidence and make informed choices that align with their best interests.

What is a reasonable amount for a Settlement Agreement?

You can expect to receive a payout that is equivalent to between 3 and 6 months of your salary in addition to any notice pay and accrued holiday pay. There are other factors that would influence the settlement figure reviewed by your Settlement Agreement Solicitors.

Factors Influencing Settlement Agreement Calculations:

1. Strength of Legal Claims:

The perceived strength of each party’s legal claims is a fundamental factor in settlement negotiations. If one party has a strong case with substantial evidence supporting their position, they may have a stronger bargaining position and be entitled to a higher settlement amount.

2. Legal Costs:

Settlement agreements often take into account the potential expenses associated with protracted litigation. A reasonable settlement amount may include provisions for covering legal costs incurred by both parties.

3. Risk and Uncertainty:

The inherent risks and uncertainties associated with litigation are crucial considerations in settlement negotiations. The prospect of an unpredictable court outcome may motivate parties to reach a settlement that provides a degree of certainty, even if it means compromising on certain aspects of their claims.

4. Economic Damages:

In cases involving financial compensation, the calculation of economic damages plays a pivotal role in determining a reasonable settlement amount. This may involve assessing direct financial losses, lost profits, or any other quantifiable economic harm suffered by the aggrieved party.

5. Non-Economic Factors:

Settlement agreements may extend beyond purely monetary considerations. Non-economic factors, such as reputational damage, business relationships, or other intangible concerns, can influence the negotiation process. Parties may be willing to compromise on financial terms to secure favourable non-monetary outcomes.

6. Precedents and Case Law:

Parties and their legal representatives often refer to past judgments to gauge the likely outcomes of their case in court. Settlement amounts may be influenced by established legal principles and decisions in similar cases.

7. Public Interest:

In certain cases, the public interest may be a factor in determining a reasonable settlement amount. This is particularly relevant in cases involving regulatory compliance, environmental issues, or matters of significant public concern.

The determination of a reasonable settlement amount in English law is a highly intricate process that involves a careful weighing of multiple factors.

Legal professionals, when advising their clients, must conduct a thorough analysis of the specific circumstances surrounding the dispute to arrive at a settlement amount that reflects the interests and rights of all parties involved.

Are there any restrictive covenants in your Settlement Agreement?

1. Defining Restrictive Covenants

Restrictive covenants are clauses within a contract that impose limitations on the actions of one or more parties.

These restrictions are designed to safeguard the interests of the parties involved and may take various forms, including non-compete clauses, non-solicitation clauses, and confidentiality clauses.

Non-compete clauses prohibit a party from engaging in activities that directly compete with the other party’s business. Non-solicitation clauses, on the other hand, restrict the solicitation of employees, clients, or suppliers for a specified period after the termination of the agreement.

Confidentiality clauses, as the name suggests, aim to protect sensitive information shared between the parties.

2. Enforceability of Restrictive Covenants

While restrictive covenants serve legitimate purposes, their enforceability is subject to scrutiny by English courts. The courts apply a reasonableness test to determine whether the restrictions imposed by a covenant are fair and proportionate. This test considers factors such as the geographical scope, duration, and the legitimate business interests that the covenant seeks to protect. This is another reason why it is crucial to select the right Settlement Agreement Solicitors to support you.

- Geographical Scope: A restrictive covenant must define the geographical area to which it applies. Courts are more likely to enforce covenants with reasonable geographic restrictions that are directly tied to the parties’ business interests.

- Duration: The timeframe for which a restrictive covenant remains in force is a crucial factor. Courts assess whether the duration is reasonable based on the nature of the industry and the time required to protect the specified business interests.

- Legitimate Business Interests: To be enforceable, a restrictive covenant must serve a legitimate business interest, such as protecting trade secrets, client relationships, or goodwill. A covenant that goes beyond safeguarding these interests may be deemed unreasonable and unenforceable.

The presence of restrictive covenants in an agreement adds a layer of complexity and it is vital to secure the right advice from your Settlement Agreement Solicitors.

Do I have to pay Tax on my Settlement Agreement?

The taxation of settlement agreements depends on the nature of the compensation received. Generally, the following principles apply:

Payment in Lieu of Notice (PILON):

PILON is generally subject to income tax and National Insurance contributions. However, if there is a contractual PILON clause in the employment contract, it will be fully taxable, regardless of the amount.

Other Benefits:

Non-cash benefits or benefits in kind provided as part of the settlement may also have tax implications.

It is crucial to note that tax laws can be complex and subject to change. It is advisable to seek professional advice, such as consulting with a tax advisor or HM Revenue & Customs (HMRC), to ensure accurate and up-to-date information tailored to your specific situation.

Failure to report taxable income may result in penalties, so it’s important to understand the tax implications of your settlement agreement.

This response provides a general overview, and individuals should consult with a tax professional for advice specific to their circumstances.

Statutory Redundancy Pay:

Statutory redundancy pay is tax-free up to a certain limit. Any amount exceeding this limit may be subject to income tax.

Compensation for Loss of Employment/Ex-Gratia Payments:

Payments specifically related to the termination of employment, such as compensation for loss of office/ex-gratia payments, are typically not taxable as earning up to £30,000. Any amount above this threshold may be subject to income tax.

Partnering With Leading Solicitors

We are not a solicitors firm. We partner with highly recommended third-party solicitors on our panel and get to know the individual lawyers to enable a personal service where we can introduce you to the individual lawyers at those third-party firms.

We're here & happy to help

Below you will find some of our most commonly asked questions about My Legal Club generally. Simply click or tap the question to view the answer. For anything else you can contact one of the team by emailing info@mylegalclub.co.uk.

What does My Legal Club do?

My Legal Club was founded by an experienced solicitor so you can be certain we have cherry-picked the most highly recommended third-party panel solicitors to help you. The panel solicitors have the experience and expertise to help whenever you need legal advice and support. They have agreed to the highest standards of customer care and support ensuring you receive the very highest standards of service.

If you need legal advice or support we can help you!

We are not a solicitors firm. My Legal Club Limited is a claims management company and is authorised and regulated by the Financial Conduct Authority (FRN834278)

Why should I instruct a solicitor via My Legal Club?

On 8th March 2019 we launched a twitter poll asking participants what their biggest consideration was when selecting a solicitor. Over 90% of participants in the poll voted in favour of a recommendation / recommended solicitor.

Who is qualified to recommend a solicitor firm? How do you know they have the expertise and ability to provide you with the best service possible at a great price?

The Management team at My Legal Club works within the legal services industry. We have cherry-picked the law firms across the country that we feel provide the levels of service that we would want if we needed help in that area.

My Legal Club ensures that the law firms have the correct accreditation’s and insurance in place to ensure your case is secure in their hands.

My Legal Club has a strict level service agreement and standards of customer service that must be upheld by their panel firms to ensure that their standards remain as high as possible and you receive the level of care and support you deserve.

All our member firms are solicitors of England and Wales and authorised and regulated by the Solicitors Regulation Authority. The Authority’s rules can be accessed via their website.

Any solicitor we refer you to is an independent professional, from whom you will receive impartial and confidential advice. You are free to choose another solicitor if you so choose but we would, of course, welcome feedback as to why.

Is My Legal Club a solicitors firm?

No. My Legal Club is not a solicitors practice. My Legal Club Limited is a claims management company and is authorised and regulated by the Financial Conduct Authority (FRN834278). Full details are contained within our footer.

Which areas of law are defined as regulated for the purposes of customer protection by the FCA?

Authorised and regulated by the Financial Conduct Authority (FCA)

My Legal Club Limited is authorised and regulated by the Financial Conduct Authority (FCA) reference: (FRN834278).

My Legal Club is a claims management company and only undertakes marketing activities that comply with Solicitors Regulation Authority (“SRA”) Handbook (in particular, Chapter 8 - Publicity).

Under the regime operated by the Claims Management Regulator (CMR), the FCA grant permission for all regulated claims management activity across 6 sectors.

The areas of law that are classed as regulated and where the FCA provides consumer protection are financial services and products, personal injury, housing disrepair, specified benefit, criminal injury, and employment.

Areas that can be defined as “non-regulated” and will not benefit from customer protection by the FCA include all areas of law not listed above, e.g. conveyancing, wills, probate, family law, divorce, commercial, etc.

Any solicitor we refer you to is an independent professional from whom you will receive impartial and confidential advice. You are of course free to choose another solicitor.

Does using My Legal Club cost me anything?

If you contact us wanting assistance with a legal query via our panel solicitors then My Legal Club does not take any money from you. We put you in touch with our highly recommended solicitors. When you speak with the solicitor they will then explain what they can, or can't, do to help and quote for any work you want them to perform.

Is my data secure? Will anyone (such as my employer) know that I have contacted you?

My Legal Club handles your data and your inquiry with extreme sensitivity. All the panel member law firms are required to ensure confidentiality and respect your privacy. Further information is located on our site regarding privacy and your data.

Your inquiry will be forwarded to the appropriate solicitor with the request to contact you via your preferred method of contact at your preferred date and time.

How do I pass on any feedback or raise a complaint?

If you have a complaint, please review our complaints procedure which is located under the title “Complaints Procedure” within the footer of this website and within our Terms of Use. You can also contact us at info@mylegalclub.co.uk.

If the Complaint is in respect of any additional benefit with a third-party company we will forward your email to our commercial partner who operates the scheme and they will handle your complaint in accordance with the terms and conditions you agreed to when you first use their site. It is then for them to liaise with you directly in respect of your complaint or query.

Do you have a vulnerable person policy?

Yes. This is included below and within our Terms of Use.

We aim to identify those clients who may be at risk of being vulnerable by virtue of their age, disability or circumstance. This Policy is written as our commitment to such clients.

- It is important to us that we are able to identify clients who may be vulnerable and we are committed to training all our team to identify key indicators such as age, disability or clients who find themselves in a particularly stressful situation where their judgment may be impaired or they may be vulnerable to influence or exploitation.

- We aim to treat older clients, their families, and representatives, with additional consideration, by being both sympathetic and sensitive to any issues they may have. We also aim to ensure that our team also treats such clients with dignity, kindness, and respect at all times.

- Where a client prefers to communicate with us with another person present (via email as an example), we will strive to facilitate this request subject to GDPR compliance e.g. that person specifying in writing whom we should be liaising with. We will require that person’s full name and relationship to the client, and where such a person is an Attorney or Court of Protection Deputy we will ask to see evidence of this. However, we will always strive to ensure that our client understands and feels at ease if they are alone with us.

- Where English is not the first language of our client or has difficulty hearing or with sight, we suggest that an appropriate independent interpreter assists, or a person that our client trusts to help the client understand what is being discussed. We will be mindful of any other limitations such as mobility or capacity and provide every support to enable our client to communicate and feel comfortable in providing their instructions. We can provide large print, Braille or sign writing facilities as necessary.

- We will use plain English and where legal terminology has to be used we will ensure that our client understands and will not proceed until we are sure of this.

- We are an online business but should any face to face meetings be required we shall ensure we have disabled access with disabled parking and toilet facilities.

- We are obliged to verify the identification of all our clients but are mindful that some of our older clients do not have valid passports or driving licenses and will adapt our procedures to accommodate such clients when necessary provided that this does not compromise our own money laundering requirements. The ID will be required for any solicitor, Deputy or other agents for our client.

- We are aware that many of our older clients are computer literate and will feel comfortable communicating via email, but we will never insist on this form of communication and will make our older clients feel at ease by sending letters by post if this is preferred and we are happy to send duplicate correspondence to a family or trusted support provided that such authority is provided by the client.

- We will always act in the client’s best interests and where we have concerns as to vulnerability, capacity, coercion or undue influence we will do our best to seek our client’s permission to refer him/her if necessary for a further professional opinion.

No Win No Fee

If your action is subject to a potential claim where no win no fee may be considered there are important points to note.

We are authorised and regulated by the Financial Conduct Authority and all of our panel solicitors handling no-win no-fee claims are solicitors of England and Wales and authorised and regulated by the Solicitors Regulation Authority.

There are a number of personal injury/financial mis-selling/housing disrepair companies out there that claim they offer no win no fee agreements, when in fact there are hidden charges in the service they offer. It is important to use an experienced firm of solicitors with vast experience and come highly recommended, as is the case with our panel firms.

Once you have contacted us to make an initial inquiry about no-win no-fee compensation our experienced team will check our third-party panel solicitors will be able to help you.

The funding of the case and charges that apply will be addressed by solicitors at the very start and before you have formally instructed them.

Typically, in no-win no-fee clients pay between 15% and 36% of the amount that is recovered. This can vary and may be more or less e.g. some firms may charge 36%, others may charge 15%, and others may operate a sliding scale based upon the way the case progresses. The solicitors need to consider various factors that they will explain to you when assessing the amount to be charged before you agree to instruct them. The amount charged will be subject to your individual circumstances and the actual fee may be more or less than those stated. A termination fee may be charged if you cancel outside the 14-day cooling-off period.

Panel solicitors of My Legal Club apply condition 1 namely:

“1. Commonly, No Win No Fee claims provide you with an opportunity to claim for compensation regardless of your financial position. They are most commonly referred to when discussing personal injury claims, but also include housing disrepair claims, financial mis-selling claims, and other areas of civil law such as employment claims .”

All of the My Legal Club panel solicitors can handle your claim on a no-win no-fee basis. If you are unsuccessful with your claim then you don’t have to pay a penny.

Since April 2013 anyone who claims for personal injury will be subject to the amendments made to the law including qualified one-way cost shifting. Our panel solicitors will explain all of this to you and explain why it reduces the risk of you being liable for any fees in the event that you lose your claim.

Not all personal injury claims can proceed by way of a Conditional Fee Agreement (where the solicitor is paid costs by the party to blame if the claim is successful). Where personal injury claims proceed on a Conditional Fee Agreement the Members of My Legal Club do not need to worry about legal fees or any deductions for solicitor costs if their claim is successful and they have told the truth and co-operated with the solicitor throughout.

If the claim, whether that be for personal injury or financial mis-selling etc, can not proceed by way of a Conditional Fee Agreement and an alternative agreement is required the solicitor will explain this to you at the very start and before you decide to make a claim. As an example it may be that that due to the government reforms your solicitor may not be able to able to recover any costs if they win your claim and as a result need to operate a different form of no-win no-fee agreement such as a contingency fee agreement, or Damages Based Agreement (DBA).

The solicitors will discuss and confirm the funding options available and all the terms and conditions at the very start and before you proceed to enable you to be fully informed and make a decision about whether you wish to proceed.

Solicitors will ask whether you have the benefit of a legal expense insurance policy (typically on car insurance, home insurance etc). If the answer is yes our solicitors will assess whether this policy will indemnify and protect you in the event of you pursuing a personal injury claim and that claim either being unsuccessful and/or you potentially being exposed to any adverse costs or disbursements/expenses incurred.

In the event that you do not have the benefit of a legal expense insurance policy as per the above, the panel solicitors of My Legal Club may put in place an ‘After the Event’ insurance policy which will protect you from disbursements/expenses incurred in the event of you losing your claim.

This is of course subject to your adherence to their policy terms and conditions.

The cost of the after the event insurance policy will be discussed with you by our panel solicitor and if you agree to proceeding with your claim will result in the cost of the policy only being deducted from your compensation if you are successful.

There is no charge applied for the policy if you are unsuccessful and you have adhered to the terms and conditions of the policy.

This is how the claim is "No Win No Fee" and why you will not incur any adverse costs or disbursements/expenses in the event of a failed claim. There is no up front charge applied for the after the event insurance policy and also no charge if you are unsuccessful and you have adhered to the terms and conditions of the policy.

A cancellation fee will often be incurred if you cancel a claim with the solicitor outside the cooling off period. In addition, if you exaggerate, lie or deceive then you are likely to incur a charge from the solicitor.

Get In Touch

Book a FREE & no-obligation call & review

Speak with David Brown Leading Settlement Agreement Solicitor

Over 20+ years experience with Settlement Agreements and Employment Law